October 25, 2025 | 02:15 pm

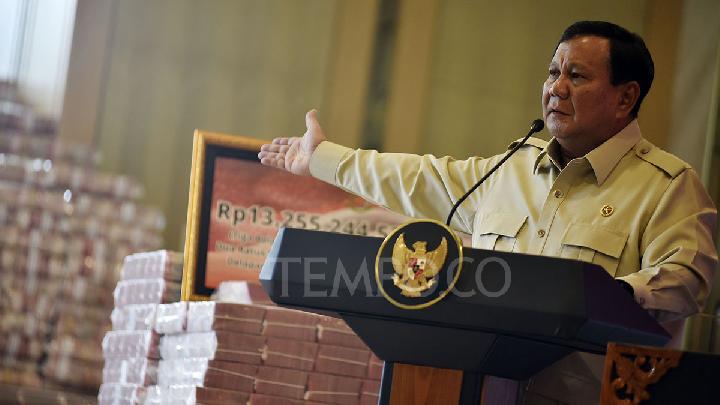

TEMPO.CO, Jakarta - Finance Minister Purbaya Yudhi Sadewa stated that Bank Mandiri has requested an additional placement of Excess Budget (SAL) funds, as it has fully utilized the initial injection of Rp55 trillion. "Earlier, I met someone from Danantara. It seems Mandiri will request more funds because the Rp55 trillion has been fully deployed," said Purbaya, citing Antara on Saturday, October 25, 2025.

Purbaya confirmed that the government is prepared to re-place these funds into the State-Owned Banks Association (Himbara) if the national economy's stimulus is not yet optimal.

So far, Purbaya assessed that the fund injection has positively impacted economic activity. This is reflected in the growth of bank credit and retail sales data reported by Bank Indonesia (BI).

"The economy seems to be picking up. But I will monitor it again. If it's still not enough, we will push again," the Finance Minister commented.

BI data noted that bank credit grew by 7.7 percent in September 2025, a slight increase compared to the 7.56 percent growth recorded in August 2025.

The Minister attributed the relatively moderate credit growth primarily to unstable economic conditions, which were influenced by demonstrations that escalated into riots some time ago. He noted that the fourth quarter provides sufficient time to observe the full development of bank credit throughout 2025.

In early September, the Ministry of Finance transferred Rp 200 trillion in SAL funds from Bank Indonesia to five banks comprising the Himbara. The distribution was as follows: Bank Mandiri: Rp 55 trillion; BRI: Rp 55 trillion; BNI: Rp 55 trillion; BTN: Rp 25 trillion; and BSI: Rp 10 trillion.

Meanwhile, Bank Indonesia Governor Perry Warjiyo stated that the government's fund placement in the banking sector has significantly boosted the amount of money circulating in the economy. Adjusted primary money (M0) recorded an 18.58 percent year-on-year (y-o-y) growth in September 2025, which is higher than the growth of non-adjusted M0, which stood at 13.16 percent y-o-y.

Adjusted primary money refers to the primary money supply that accounts for the impact of reducing the Minimum Reserve Requirement (GWM) of banks in Bank Indonesia due to the provision of the macroprudential liquidity incentive policy (KLM).

Editor's Choice: The Risks Behind Danantara's Move to Enter Indonesian Capital Market

Click here to get the latest news updates from Tempo on Google News

Purbaya Imposes Tariffs on 27 Textile Imports

5 jam lalu

The Indonesian Trade Security Committee (KPPI), under Purbaya, announced the imposition of safeguard import duties on 27 HS codes of cotton yarn.

Over 200 Investors Keen to Invest in Indonesia's Waste-to-Energy Project

16 jam lalu

Danantara is currently selecting investors to join the project.

Coretax Repair Set to Finish in January 2026, Says Finance Minister Purbaya

18 jam lalu

Minister of Finance Purbaya Yudhi Sadewa explains that the disruption in the Coretax system occurred in four main layers.

The Risks Behind Danantara's Move to Enter Indonesian Capital Market

18 jam lalu

The plan for Danantara to enter the stock market is not new, as in April, it opened opportunities to become a liquidity provider in the capital market.

Bank Indonesia Launches QRIS Tap Payment Service in West Java

19 jam lalu

The Trans Studio Bandung Mall and the Metro Jabar Trans buses were the first to implement QRIS Tap payments.

Indonesia's Purbaya Will Ask Ministries to Hire Hackers to Boost Cybersecurity

21 jam lalu

Purbaya revealed that the Ministry of Finance has involved several Indonesian hackers to help improve the system's cybersecurity.

Today's Top 3 News: Jonatan Christie Knocked Out as Alwi Farhan Reaches Quarterfinals

21 jam lalu

Here is the list of the top 3 news on Tempo English today.

Investor Confidence Falters Under Prabowo's Policies

22 jam lalu

A year into Prabowo Subianto's presidency, fiscal uncertainty persists as investor confidence weakens.

China Reaffirms Support for Indonesia's Whoosh High-Speed Rail Amid Debt Talks

1 hari lalu

A Chinese spokesperson said that Whoosh, Southeast Asia's first high-speed rail, has shown positive results since beginning operations two years ago.

Indonesia's HM Sampoerna Acquires Rp500 Billion in Patriot Bonds

1 hari lalu

Secretary of HM Sampoerna Company Andy Revianto stated that the investment in this debt securities accounts for 1.76 percent of the company's equity in 2024.

:strip_icc():format(jpeg)/kly-media-production/medias/5266507/original/093021700_1751005527-Foto_6.JPG)