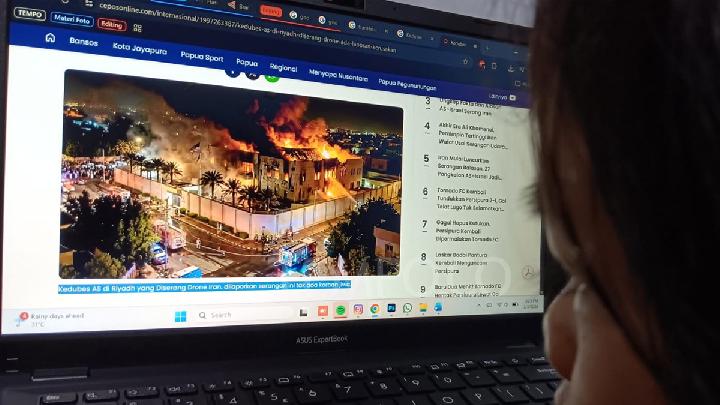

TEMPO.CO, Jakarta - The United States' strikes on Caracas and the capture of Venezuelan leader Nicolas Maduro have left the South American nation in a state of deep confusion and uncertainty.

US President Donald Trump pledged in the immediate aftermath that the US would "run" Venezuela, a move that appeared to hinge on how the US would approach the country's key commodity: oil.

"We're going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country," he said.

How key is oil to Venezuela?

Venezuela's fragile economy is exceptionally dependent on oil. Maduro's government has been almost entirely dependent on the hydrocarbon for state income.

Crude oil and related products such as petrochemicals account for around 90% of Venezuela's export revenues. They helped keep the heavily sanctioned and isolated government in power despite a severe economic crisis.

Venezuela has the world's largest proven oil reserves, with over 300 billion barrels available — even more than Saudi Arabia. However, it accounts for less than 1% of the global oil production, a figure that was more than 10% of global production in the 1960s. Crude production has collapsed by more than 70% since the late 1990s, and Venezuela is now 21st in the list of global producers.

The collapse can be traced back to the government of former President Hugo Chavez. His socialist revolution in the 1990s and 2000s led to massive corruption at the state oil company, PDVSA, and saw foreign investment flood out of the country due to government interference in the oil sector.

Several accidents at its pipelines and oil refineries led to further difficulties, while US sanctions — ratcheted up from 2017 — further limited Venezuela's oil production capacity.

PDVSA has stabilized oil output at around 1 million barrels per day, in part because of US licenses that allow a limited number of foreign partners to operate in Venezuela and export oil.

How invested are US oil companies in Venezuela?

Throughout the 20th century, the US was a key partner for the Venezuelan oil sector, with its major oil companies investing heavily in the country.

All but one left the country in the aftermath of the Chavez revolution — Chevron.

Although sanctions affected its operations, Chevron was given special licences by the Biden administration in 2022 to resume Venezuelan oil exports under strict conditions. The idea was that softening Venezuelan sanctions would ease wider oil market pressures in the wake of Russia's invasion of Ukraine.

In October this year, the Trump administration gave Chevron fresh authorization to produce oil in Venezuela, arguing the US company was a vital partner for Caracas.

It stands as the most obvious and immediate beneficiary of any move by Trump to allow further US investment in the country. It employs around 3,000 people there already. In a statement, the company said it would operate in "full compliance with all relevant laws and regulations." It did not comment on any possible expansion plans.

Trump says large US oil companies will return to Venezuela under his plan. That could include the likes of ExxonMobil and ConocoPhillips.

ExxonMobil, the largest US oil company, saw its assets expropriated by Chavez in 2007. ConocoPhillips' projects at Hamaca, Petrozuata and Corocoro were also expropriated. Both companies won multi-billion-dollar compensation awards in international arbitration, but Venezuela has not paid out. This is the basis of Trump's repeated claim of "stolen oil."

"We built Venezuela's oil industry with American talent, drive and skill, and the socialist regime stole it from us during those previous administrations, and they stole it through force," Trump said. "This constituted one of the largest thefts of American property in the history of our country."

ConocoPhillips said it is "monitoring developments in Venezuela and their potential implications for global energy supply and stability." It would be premature to speculate on any future business activities or investments," a spokesman added.

Does the US really need Venezuelan oil?

The US is already comfortably the world's biggest producer of oil, so at first glance, it might not seem clear why Trump is so keen on Venezuela's oil.

However, the issue is the type of oil the US produces. Its main product is light crude, not the heavier, gloopier grade that many of its refineries, especially on the Gulf coast, are equipped to refine. Refineries turn crude oil into petrol, diesel and other products crucial for the economy.

Although the US is a major crude producer, it still imports heavy crude from countries such as Canada and Mexico to supply refineries optimized for those grades. That means a lot of the crude oil produced in the US actually ends up being exported.

"Using the right types of crude oil keeps our refineries efficient, keeps costs down and maintains energy security," according to the American Fuel and Petrochemical Manufacturers (AFPM) trade association. "Re-tooling refineries to process solely US crude oil would cost billions — a risky investment that would take decades to permit, construct and eventually pay off."

Although Venezuela's production has fallen off a cliff, the massive reserves it sits on include the largest global reserves of heavy crude oil that the US refineries need. In fact, for many decades, heavy Venezuelan crude fed US refineries.

That makes renewed access to Venezuelan oil extremely attractive for US companies.

Can Trump make good on his oil promise?

There are huge legal and logistical questions over whether or not oil will start flowing from Venezuela again.

Precisely what government will take shape in Venezuela in the absence of Maduro is unclear. It is also unknown to what extent the new government will facilitate US attempts to influence the country's oil sector.

Then there is the question of the state of Venezuela's oil infrastructure. Dan Brouillette, a former US Secretary of Energy from the first Trump administration, says that while early reports suggest the country's oil facilities remain intact, there is no guarantee that Venezuela's massive reserves can be tapped quickly.

"The constraint has never been geology. It has been governance, sanctions, capital access, and execution," he wrote on LinkedIn. "If political change brings rapid stabilization and credible authority over PDVSA, the upside is incremental supply over time, not a sudden surge."

Although some foreign oil companies have remained in Venezuela, sanctions have meant that the country's oil facilities have not received the necessary investment to remain up to date. The extent of the fresh investment required may become clearer over the coming months.

Another key question is the world's appetite for more oil. Prices have fallen over the past year and are expected to fall further in 2026 amid a production glut. If Trump's promise on Venezuela comes good, it would lead to even more oil on already saturated global markets.

What about China?

China has been an important political and economic partner for Venezuela over the past two decades.

In the oil sector, China's CNPC has a joint venture with PDVSA. Most of the oil produced in Venezuela gets shipped to China. However, China has not hugely expanded its oil operations in Venezuela despite the US absence.

Beijing has sharply criticized the US toppling of Maduro as a violation of Venezuela's sovereignty.

Read: Trump Unveils More Details About Maduro's Abduction

Click here to get the latest news updates from Tempo on Google News

:strip_icc():format(jpeg)/kly-media-production/medias/5357081/original/011599400_1758518426-expressive-young-girl-posing.jpg)