January 8, 2026 | 09:46 pm

TEMPO.CO, Jakarta - Indonesian rupiah closed weaker against the US dollar this afternoon, attributed to US' internal turbulence, geopolitical tensions, and domestic financial situation, said the director of PT Traze Andalan Futures, Ibrahim Assuaibi.

"This afternoon, the rupiah closed 18 points weaker at Rp16,798 from the previous closing of Rp16,780," he said in a written statement on Tuesday, 6 January 2025.

Ibrahim projected the rupiah would fluctuate tomorrow, but close weaker between Rp16,780 and Rp16,810 per US dollar.

External factors greatly influence the exchange rate in today's trading, as the US business activities improved despite the slow growth of the labor market. The Institute for Supply Management Services Purchasing Managers' Index surged from 52.6 to 54.4, exceeding the market's estimate of 52.3.

According to data from the US Department of Labor in the November Job Openings and Labor Turnover Survey (JOLTS) report, there were 7.146 million job openings, down from 7.449 million in October. Another focus of the global market is the upcoming release of initial weekly unemployment claims and the Nonfarm Payrolls report for December.

"The report from the US labor market is expected to drive gold prices back up if the labor market continues to deteriorate," said Ibrahim.

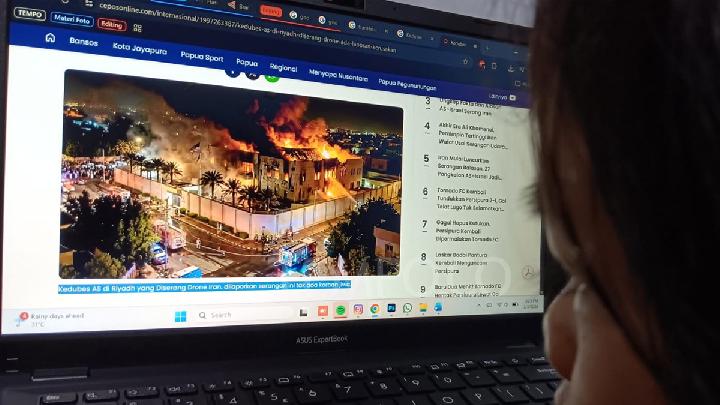

Meanwhile, the United States is set to receive 30-50 million barrels of crude oil from Venezuela following the abduction of President Nicolas Maduro. Washington is also considering controlling Venezuela's oil company, Petróleos de Venezuela SA, or PdVSA.

Domestically, the country's foreign exchange reserves reached US$156.5 billion in December 2025, up from US$150.1 billion in November 2025. The increase stemmed from tax and service revenues, the issuance of global sukuk, and government loan disbursements.

"The foreign exchange reserves can support the resilience of the external sector and maintain macroeconomic stability and financial systems," Ibrahim said.

According to Ibrahim, Bank Indonesia believes that the resilience of the external sector remains strong, supported by adequate foreign exchange reserves and an expected continuous inflow of foreign capital. This aligns with the positive investor perception of the national economic prospects and the attractive investment returns.

Read: Bank Indonesia Outlines Monetary Policy Direction for 2026

Click here to get the latest news updates from Tempo on Google News

Indonesian Rupiah Closes Weaker at Rp16,780 per US Dollar

1 hari lalu

The U.S. attack on Venezuela is a key point to watch for the market, and also affects the rupiah exchange rate.

Rupiah Weakens to 16,758 per US Dollar Amid Global Unrest

2 hari lalu

The Indonesian rupiah weakened to 16,758 per US dollar on Jan. 6. Experts cite the US-Venezuela conflict and domestic inflation as the primary causes.

Indonesian Rupiah Weakens to Rp16,788 per US Dollar Amid BI Rate Cut

10 hari lalu

Rupiah closed weaker, down 43 points or about 0.26 percent to Rp16,788 per U.S. dollar.

Rupiah Climbs to 16,663 per USD After Fed's Latest Rate Cut

28 hari lalu

Even so, the rupiah's upside remains limited by domestic concerns, especially the economic impact of the Sumatra floods.

Bank Indonesia Outlines Monetary Policy Direction for 2026

40 hari lalu

This monetary policy direction is chosen amidst the ongoing global uncertainty.

Rupiah Projected to Continue Weaken Next Week

40 hari lalu

The director of PT Traze Andalan Futures, Ibrahim Assuaibi, predicts that the rupiah currency is likely to weaken in the trading session next Monday.

Bank Indonesia Holds Benchmark Rate at 4.75% to Stabilize Rupiah

50 hari lalu

Bank Indonesia also maintained the deposit facility interest rate at 3.75 percent and the lending facility interest rate at 5.5 percent.

Risk and Hope in Indonesia's Long-Awaited Rupiah Redenomination

50 hari lalu

Indonesia's Finance Ministry has revived a long-shelved project: redenominating the Rupiah by dropping several zeroes.

Rupiah Redenomination Plan Will Require Time, Says BI Governor

57 hari lalu

Bank Indonesia Governor Perry Warjiyo said the plan for the Rupiah redenomination will not be implemented in the near future.

Bank Indonesia Projects Rupiah at Rp16,430 per US Dollar in 2026

57 hari lalu

Governor Perry Warjiyo believes that the projected rupiah exchange rate is realistic. He expects global uncertainty to remain high next year.

:strip_icc():format(jpeg)/kly-media-production/medias/5357081/original/011599400_1758518426-expressive-young-girl-posing.jpg)