January 14, 2026 | 11:54 am

TEMPO.CO, Jakarta - The exchange rate of the rupiah in the trading session on Tuesday, January 13, 2026, weakened by 0.13 percent to Rp16,877 per US dollar. Bank Indonesia (BI) explained the causes of the recent depreciation of the rupiah.

The Head of Monetary Management and Securities Asset Department of BI, Erwin G. Hutapea, stated that the movements of the currencies of various countries, including the rupiah, are influenced by global conditions. "The global currency movements at the beginning of 2026, including Indonesia, are largely influenced by the increasing pressure in the world's financial markets," he said in an official statement on Wednesday, January 14, 2026.

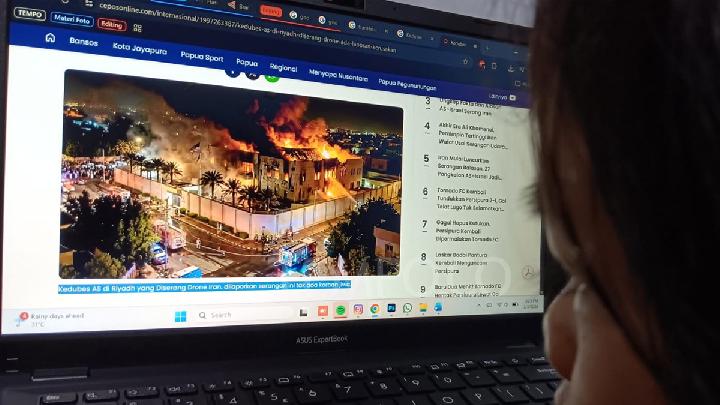

Several factors affecting the depreciation of the rupiah include increasing geopolitical tensions and concerns about the independence of central banks in several advanced countries. The uncertainty about the monetary policy direction of the US Federal Reserve, The Fed, amidst the increasing domestic foreign exchange needs at the beginning of the year.

According to Erwin, these conditions have led to the depreciation of the rupiah, which closed at the level of 16,860 per US dollar on January 13, 2026. This value depreciated by 1.04 percent since the beginning of the year or year to date.

Nevertheless, this depreciation is considered reasonable as it is in line with the trends of other regional currencies that are also affected by global sentiment. These include the weakening of the South Korean won by 2.46 percent and the Philippine peso by 1.04 percent.

BI claims that the stability of the rupiah is maintained thanks to continuous interventions by the central bank in the domestic and global markets, as well as foreign capital inflows amounting to Rp11.11 trillion in January 2026. Investor confidence remains high with low risk (CDS) at the level of 72 bps.

In addition, there are foreign exchange reserves of US$156.5 billion as a buffer against global turbulence. "Bank Indonesia will continue to be in the market to ensure that the exchange rate of the Rupiah moves in line with its fundamental value and a healthy market mechanism," said Erwin.

Read: Weakening Rupiah Could Drive Up Gold Prices in Indonesia, Says Analyst

Click here to get the latest news updates from Tempo on Google News

Weakening Rupiah Could Drive Up Gold Prices in Indonesia, Says Analyst

20 jam lalu

The rupiah exchange rate at the end of the week is likely to approach around Rp16,900. This will push the price of precious metals higher.

HSBC's 2026 Outlook: Indonesia's Stock Market Strengthens as Rupiah Weakens

1 hari lalu

HSBC Global Research predicts the Indonesia Composite Index (IHSG) could reach 9,700 this year.

Rupiah Closes Weaker Today as US Expects Venezuelan Oil Transfer

5 hari lalu

Indonesian rupiah closed weaker against the US dollar this afternoon.

Indonesian Rupiah Closes Weaker at Rp16,780 per US Dollar

6 hari lalu

The U.S. attack on Venezuela is a key point to watch for the market, and also affects the rupiah exchange rate.

Rupiah Weakens to 16,758 per US Dollar Amid Global Unrest

7 hari lalu

The Indonesian rupiah weakened to 16,758 per US dollar on Jan. 6. Experts cite the US-Venezuela conflict and domestic inflation as the primary causes.

Indonesian Rupiah Weakens to Rp16,788 per US Dollar Amid BI Rate Cut

15 hari lalu

Rupiah closed weaker, down 43 points or about 0.26 percent to Rp16,788 per U.S. dollar.

Rupiah Climbs to 16,663 per USD After Fed's Latest Rate Cut

34 hari lalu

Even so, the rupiah's upside remains limited by domestic concerns, especially the economic impact of the Sumatra floods.

Bank Indonesia Outlines Monetary Policy Direction for 2026

46 hari lalu

This monetary policy direction is chosen amidst the ongoing global uncertainty.

Rupiah Projected to Continue Weaken Next Week

46 hari lalu

The director of PT Traze Andalan Futures, Ibrahim Assuaibi, predicts that the rupiah currency is likely to weaken in the trading session next Monday.

Bank Indonesia Holds Benchmark Rate at 4.75% to Stabilize Rupiah

55 hari lalu

Bank Indonesia also maintained the deposit facility interest rate at 3.75 percent and the lending facility interest rate at 5.5 percent.

:strip_icc():format(jpeg)/kly-media-production/medias/5357081/original/011599400_1758518426-expressive-young-girl-posing.jpg)