January 15, 2026 | 12:46 pm

TEMPO.CO, Jakarta - The Indonesian rupiah opened slightly stronger on Thursday, January 15, 2026, appreciating 14 points or 0.08 percent to Rp16,851 per US dollar, compared with Rp16,865 in the previous session.

Despite the modest gain, market sentiment remains cautious. Permata Bank Chief Economist Josua Pardede said investors are closely watching Bank Indonesia’s continued efforts to stabilize the currency.

“Investors remain cautious following Bank Indonesia’s statement that it will continue to intervene in the market to stabilize the rupiah,” Josua said, as quoted by Antara on Thursday. He projected the rupiah would trade in the range of Rp16,825 to Rp16,925 per US dollar.

Earlier, Bank Indonesia’s Department of Monetary Management and Securities head, Erwin G. Hutapea, reaffirmed the central bank’s commitment to maintaining exchange rate stability to support economic growth. He said the rupiah remains relatively stable due to consistent policy measures.

Bank Indonesia has been conducting stabilization efforts through non-deliverable forward (NDF) interventions in offshore markets across Asia, Europe, and the United States.

Domestically, the central bank has intervened through spot market operations, domestic non-deliverable forwards (DNDF), and purchases of government bonds in the secondary market.

The rupiah has also been supported by continued foreign capital inflows, particularly into Bank Indonesia Rupiah Securities (SRBI) and the stock market.

Net foreign inflows reached Rp11.11 trillion in January 2026. Investor confidence remains positive, reflected in Indonesia’s five-year credit default swap (CDS) risk premium, which stood at around 72 basis points.

Indonesia’s external position also remains strong. Foreign exchange reserves at the end of December 2025 reached US$156.5 billion, equivalent to 6.4 months of imports, providing a sufficient buffer against global financial market volatility.

Bank Indonesia reiterated that it will remain active in the market to ensure the rupiah moves in line with economic fundamentals and orderly market conditions.

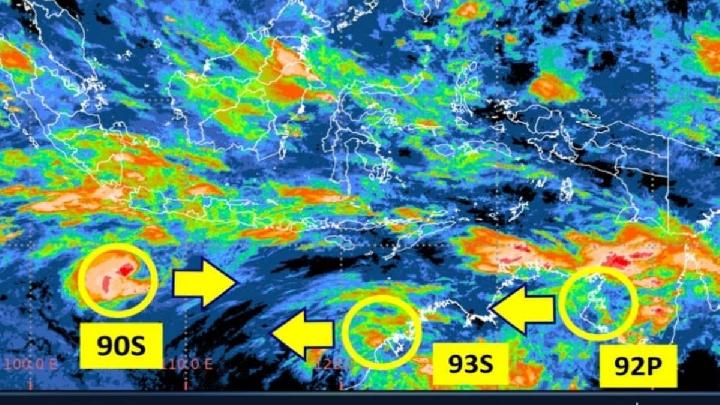

Since the start of 2026, however, the rupiah has experienced heightened volatility and a general weakening trend. The currency has traded mostly between Rp16,700 and Rp16,800 per US dollar, with its weakest level recorded at Rp16,877 earlier this week.

Read: Indonesia's Gold Prices Continue Rising Since January 10

Click here to get the latest news updates from Tempo on Google News

Indonesia's Purbaya Optimistic Rupiah Will Strengthen as Economy Recovers

23 jam lalu

Purbaya explains that foreign investors will invest in places or countries with strong economies.

Rupiah Nears 17,000 per US Dollar, Bank Indonesia Speaks Out

1 hari lalu

Bank Indonesia explains the reasons behind the recent weakening of the rupiah, which is influenced by global conditions.

Weakening Rupiah Could Drive Up Gold Prices in Indonesia, Says Analyst

1 hari lalu

The rupiah exchange rate at the end of the week is likely to approach around Rp16,900. This will push the price of precious metals higher.

HSBC's 2026 Outlook: Indonesia's Stock Market Strengthens as Rupiah Weakens

2 hari lalu

HSBC Global Research predicts the Indonesia Composite Index (IHSG) could reach 9,700 this year.

Rupiah Closes Weaker Today as US Expects Venezuelan Oil Transfer

6 hari lalu

Indonesian rupiah closed weaker against the US dollar this afternoon.

Indonesian Rupiah Closes Weaker at Rp16,780 per US Dollar

7 hari lalu

The U.S. attack on Venezuela is a key point to watch for the market, and also affects the rupiah exchange rate.

Rupiah Weakens to 16,758 per US Dollar Amid Global Unrest

8 hari lalu

The Indonesian rupiah weakened to 16,758 per US dollar on Jan. 6. Experts cite the US-Venezuela conflict and domestic inflation as the primary causes.

Indonesian Rupiah Weakens to Rp16,788 per US Dollar Amid BI Rate Cut

16 hari lalu

Rupiah closed weaker, down 43 points or about 0.26 percent to Rp16,788 per U.S. dollar.

Rupiah Climbs to 16,663 per USD After Fed's Latest Rate Cut

35 hari lalu

Even so, the rupiah's upside remains limited by domestic concerns, especially the economic impact of the Sumatra floods.

Bank Indonesia Outlines Monetary Policy Direction for 2026

47 hari lalu

This monetary policy direction is chosen amidst the ongoing global uncertainty.

:strip_icc():format(jpeg)/kly-media-production/medias/5357081/original/011599400_1758518426-expressive-young-girl-posing.jpg)