October 24, 2025 | 07:45 pm

TEMPO.CO, Jakarta - Investment Management Agency Danantara Indonesia plans to enter the Indonesian stock market. The majority of the funds acquired by Danantara come from managing dividends from several state-owned enterprises (SOEs). Danantara believes this move will strengthen the fundamental liquidity of the domestic stock market.

One of Danantara's desires to enter the stock market was revealed by the Chief Investment Officer of Danantara Indonesia, Pandu Patria Sjahrir, during the Capital Market Summit & Expo 2025 in Jakarta on Friday, October 17, 2025. "This year, we will invest 80 percent domestically. Some will be invested in the public market, bonds, and the capital market," Pandu was quoted by Tempo during a replay on the IDX YouTube account.

Pandu mentioned that Danantara is optimistic about achieving its goals and meeting its projections for entering the stock market, even though there are fewer than 10 weeks left in the year. "We will start activities, we will be active," said the former Commissioner at the Indonesia Stock Exchange (IDX).

Danantara's plan to enter the stock market is not new. In mid-April, Danantara began offering the opportunity to become a liquidity provider in the capital market. This plan emerged when the Indonesia Composite Index (IHSG) plummeted significantly and the IDX temporarily stopped stock trading.

The Director of Development of the IDX, Jeffrey Hendrik, stated that Danantara could participate in the stock market by directly engaging through exchange members. "Similar to other institutional investors," Jeffrey told Tempo on Monday, October 20, 2025.

However, the decision for Danantara to enter the stock market has received several notes from economists and capital market activists. Currently, Danantara is required to focus on the financial restructuring of state-owned enterprises by strengthening their structures and governance in order to promote healthy growth.

"From there, Danantara will obtain optimal dividends without having to directly purchase shares," said Lucky Bayu Purnomo, founder of LBP Enterprises investment company, when contacted on Wednesday, October 23, 2025.

Lucky mentioned that the Indonesian stock market will become efficient if its transaction processes and culture are dominated by pure investor-oriented towards proportional capital optimization. Meanwhile, if Danantara pours in so much capital to enter this market, it is feared that it will only backfire for the investment body.

In Lucky's view, Danantara's decision to enter the stock market must be accompanied by a mature strategy and consideration. He assessed that Danantara's image could be pressured by the current market conditions, which are experiencing a decline. Its investment value would also be corrected, just like that of other institutional investors. "However, if the market is in a growth phase, Danantara's strategy to invest in state-owned enterprise stocks or bonds will be positively welcomed by the market," he said.

Lucky explained that in a scientific market approach, investors are familiar with the term Capital Asset Pricing Model (CAPM). This is a reference to measure the relationship between return and risk, so that investors are not only pursuing short-term gains. However, he said it is necessary to understand systemic risk and market volatility.

He cautioned that Danantara's presence in the stock market could create abnormal dynamics in stock price movements. In the Efficient Market Hypothesis approach, however, an efficient market is defined as one in which stock prices fully reflect all available information. "This means that there are no parties, both individuals and institutions, consistently outperforming the market. Danantara should not act as a short-term price mover, but as a guardian of governance and investment stability," said Lucky.

To Tempo, Vice President of PT Samuel Sekuritas Indonesia, Muhammad Alfatih, stated that every decision will have its own risks, including Danantara's decision to enter the Indonesian stock market. Alfatih requested that Danantara's plan not be associated with political matters, but rather be based on investment considerations.

According to him, if its initial purpose is merely for image building without in-depth investment views, investors will not care about such a move and may even punish it through the market. However, if it is fundamentally sound, Danantara's investment will create momentum to minimize the downside of stock prices. "Support such as placing professional individuals in state-owned enterprise management will greatly strengthen investor confidence in better management," said Alfatih on Wednesday, October 23, 2025.

Han Revanda Putra contributed to the writing of this article

Editor's Choice: Danantara Set to Invest the Indonesian Stock Market

Click here to get the latest news updates from Tempo on Google News

Today's Top 3 News: Jonatan Christie Knocked Out as Alwi Farhan Reaches Quarterfinals

3 jam lalu

Here is the list of the top 3 news on Tempo English today.

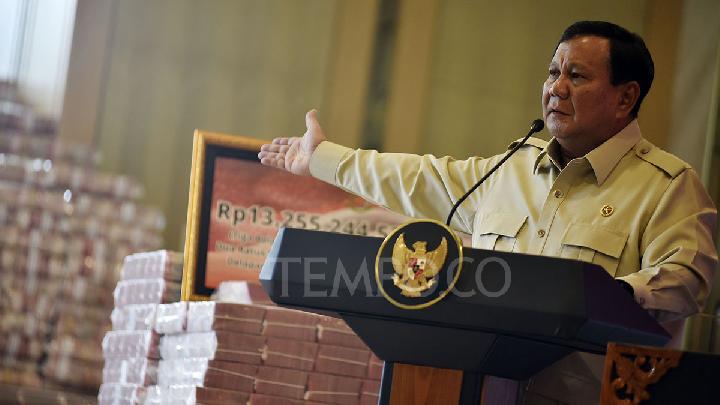

Investor Confidence Falters Under Prabowo's Policies

4 jam lalu

A year into Prabowo Subianto's presidency, fiscal uncertainty persists as investor confidence weakens.

China Reaffirms Support for Indonesia's Whoosh High-Speed Rail Amid Debt Talks

8 jam lalu

A Chinese spokesperson said that Whoosh, Southeast Asia's first high-speed rail, has shown positive results since beginning operations two years ago.

Indonesia's HM Sampoerna Acquires Rp500 Billion in Patriot Bonds

9 jam lalu

Secretary of HM Sampoerna Company Andy Revianto stated that the investment in this debt securities accounts for 1.76 percent of the company's equity in 2024.

Danantara and SOEs Potential Collision of Interests

10 jam lalu

The Prabowo administration revised the State-Owned Enterprises or SOEs Law twice in a year. Extending the bureaucratic chain.

Chinese Ambassador Deems Indonesia's High-Speed Rail Debt Talks 'Reasonable'

11 jam lalu

Chinese Ambassador Wang Lutong expressed the Chinese government's pride in the performance of the Jakarta-Bandung High-Speed Rail or Whoosh service.

Indonesia's Stock Index Closes Higher on Positive Domestic Economic Sentiment

23 jam lalu

Indonesia's stock index (IHSG) closed higher on Thursday afternoon, in line with positive sentiments from domestic economic policies and data.

Danantara Confident Whoosh Debt Restructuring Will Conclude This Year

23 jam lalu

COO of Danantara Indonesia, Dony Oskaria, ensures the debt restructuring for the Jakarta-Bandung high-speed train, or Whoosh, will be completed this year.

MSMEs Minister Admits Indonesia Unable to Counteract Effects of Imported Goods

1 hari lalu

Indonesia's Minister of MSMEs, Maman Abdurrahman, addresses the surge of imports entering Indonesia and disrupting the local market.

Indonesia Eyeing to Build 30 Incinerators by 2027 for Waste-to-Energy Megaproject

2 hari lalu

Zulkifli says that other countries have been using waste incinerators for 20 years.

:strip_icc():format(jpeg)/kly-media-production/medias/4548967/original/094336900_1692782124-tanaphong-toochinda-FEhFnQdLYyM-unsplash.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5327418/original/014991800_1756180726-alexandr-podvalny-TciuHvwoK0k-unsplash.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/3279101/original/098164400_1603767645-andrea-bertozzini--UkZIGs4ejo-unsplash.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4051493/original/078187600_1655119675-pexels-andrea-piacquadio-3820120.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5395215/original/007113100_1761665026-WhatsApp_Image_2025-10-27_at_13.37.11_2916f394.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5379294/original/048844700_1760340561-pexels-eren-li-7169042.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5375405/original/050547600_1759921524-pexels-kelvinocta16-1973270.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5361900/original/014213200_1758797231-prostooleh.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5131632/original/033958900_1739420740-pexels-runffwpu-2787861.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5361908/original/053516400_1758797575-Photo_1.jpeg)

:strip_icc():format(jpeg)/kly-media-production/medias/5331910/original/072110300_1756451465-sigmund-TJxotQTUr8o-unsplash.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5355687/original/010864400_1758350038-high-angle-boy-concentrated-reading.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5050523/original/046365500_1734147533-Screenshot_2024-12-14_at_10.32.31.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4701786/original/013309600_1703841814-jonathan-borba-Z1Oyw2snqn8-unsplash.jpg)